Dream Industrial REIT owns, manages and operates a portfolio of 339 industrial assets totalling approximately 71.9 million square feet of gross leasable area in key markets across Canada, Europe, and the U.S. as at June 30, 2024.

- Overview

- Investors

- About

- Sustainability

- Portfolio

- Team

- News

Overview

Highlights of our European Portfolio

Highlights of our Developments

Have a question for us?

Investor Inquiries

Dream Industrial REIT 30 Adelaide Street East, Suite 301, Toronto, ON M5C 3H1Transfer Agent

Computershare Investor Services 100 University Avenue, 8th Floor, Toronto, ON M5J 2Y2For Dream Industrial REIT assets only as at September 30, 2023.

(1) Number of assets comprises a building, or a cluster of buildings in close proximity to one another attracting similar tenants.

(2) Includes the Trust’s owned and managed properties as at September 30, 2023. Managed properties include U.S. assets in the U.S.

industrial fund (“the U.S. Fund”) for which the Trust provides property management, construction management and leasing services at market rates.

(3) Includes the Trust’s share of equity accounted investment as at September 30, 2023.

Investors

Financial Reports and Filings

- Financial Reports

- Regulatory Filings

Analysts

Have a question for us?

Investor Inquiries

Dream Industrial REIT 30 Adelaide Street East, Suite 301, Toronto, ON M5C 3H1Transfer Agent

Computershare Investor Services 100 University Avenue, 8th Floor, Toronto, ON M5J 2Y2About

Dream Industrial REIT

Dream Industrial REIT is a pure-play industrial REIT that owns high-quality industrial properties across Canada, the U.S. and Europe

Our Strategy

Dream Industrial REIT’s core strategy is to grow our portfolio of industrial properties across Canada, the U.S. and Europe, providing a solid platform for stable and growing cash flows by:

• owning and operating a high-quality portfolio of industrial assets in markets with strong operating fundamentals;

• investing in our key markets in industrial assets offering long-term cash flow and net asset value growth prospects;

• maximizing the value of our industrial assets through innovative asset management strategies;

• providing compelling total returns to our unitholders, anchored by sustainable cash distributions; and

• integrating sustainability at the corporate and property levels.

Global Acquisition Platform

Local on the ground teams with a strong track record of sourcing attractive industrial opportunities across North America and Europe.

Development & Intensification

Building prime assets in core markets and access excess density on existing sites to generate enhanced returns.

Active Asset Management

Unlock organic NOI and NAV growth; optimize performance, maintain value, and attract and retain tenants.

Conservative Financial Policy

Maintain conservative leverage, build up high quality unencumbered investment properties pool, optimize financing costs and preserve liquidity.

Private Capital Partnerships

Leverage local operating platforms through our private capital partnerships to generate recurring property management and leasing fees.

Property Management

Dream Industrial Management Corp. provides real estate services – including property management and leasing – to properties owned by Dream Industrial REIT.

Our management team and staff are committed to:

Continually improving the quality of our office communities through efficient property management, value added services for our tenants and capital improvements to our assets; and providing customer service excellence. Our top priority is providing a physical environment essential to the well-being of our tenants and the success of their business.

An important key to our success is our vertically integrated property management operations, which includes tenant services and property operations, lease administration accounting and reporting, and in-house construction management and leasing capabilities.

dreamplus

Our web-enabled response system provides tenants with the ability to submit and monitor their service requests online.

Whether it’s a light bulb that needs replacing or if the temperature is just not right, simply login and enter your request. Should you have any questions or trouble logging in, please contact us at [email protected]

How To: Dream Plus Guide

Sustainability

Our sustainability strategy enables us to establish meaningful and realistic benchmarks, measure our progress and integrate our environmental and social obligations into the ways we manage our business and create value.

Chief Executive Officer

Sustainability

Environmental

We strive to continuously improve the resource efficiency of our operations, lower any undesired impacts associated with our activities and contribute positively to the transition to a low carbon economy.

Social

We care for our people, tenants, partners and communities by embracing a diverse and inclusive workplace, promoting leading health and safety practices and building inclusive, attainable and sustainable communities.

Governance

We maintain the highest ethical business standards, which includes how we manage and mandate sustainability.

Sustainability Highlights

Click HereHave a question for us?

Investor Inquiries

Dream Industrial REIT 30 Adelaide Street East, Suite 301, Toronto, ON M5C 3H1Transfer Agent

Computershare Investor Services 100 University Avenue, 8th Floor, Toronto, ON M5J 2Y2Portfolio

Overview

Dream Industrial REIT owns, manages and operates a portfolio of 339 industrial assets totalling approximately 71.9 million square feet of gross leasable area in key markets across Canada, Europe, and the U.S. as at June 30, 2024. Dream Industrial REIT’s goal is to deliver strong total returns to its unitholders through secure distributions as well as growth in net asset value and cash flow per unit underpinned by its high-quality portfolio and an investment grade balance sheet.

Modern, Functional and Well Located Assets

Whitby, ON

Waddinxveen, Netherlands

Orlando, FL

Oakville, ON

Ede, Netherlands

Caledon, ON

Montréal, QC

Breda, Netherlands

Montréal, QC

Montréal, QC

Vaughan, ON

Frankfurt, Germany

Heerenveen, Netherlands

Richmond Hill, ON

Dresden, Germany

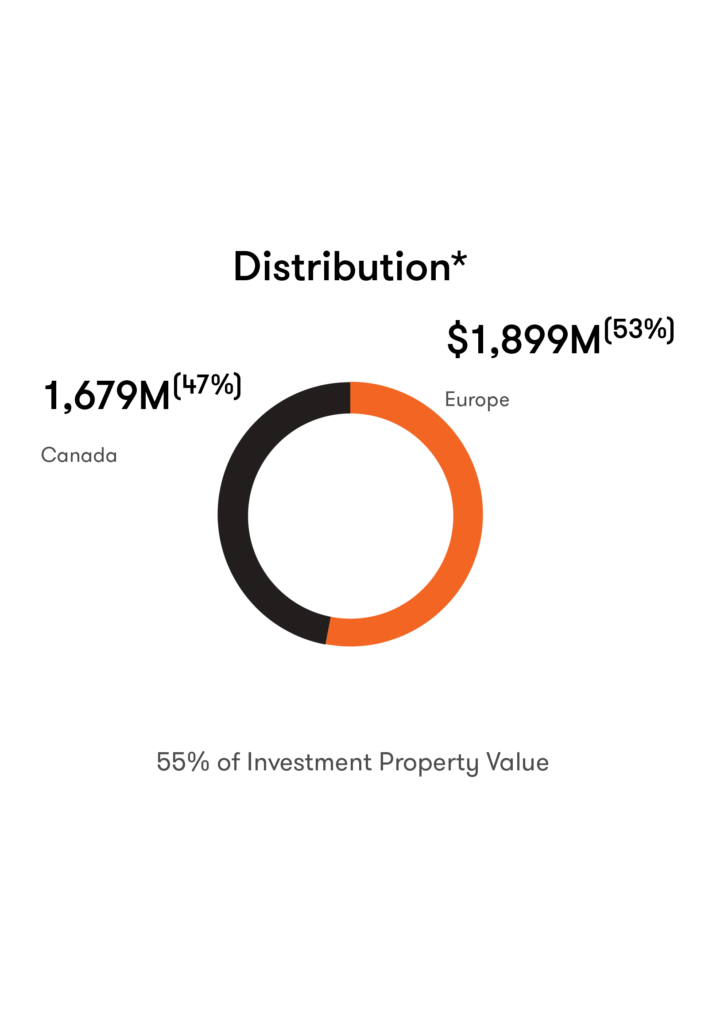

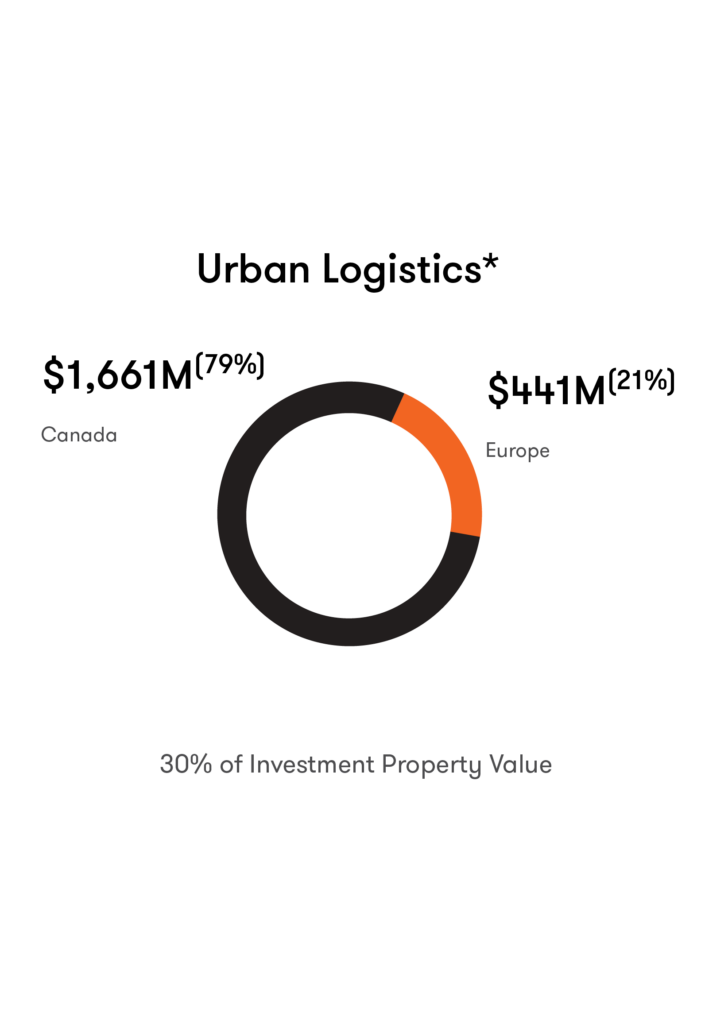

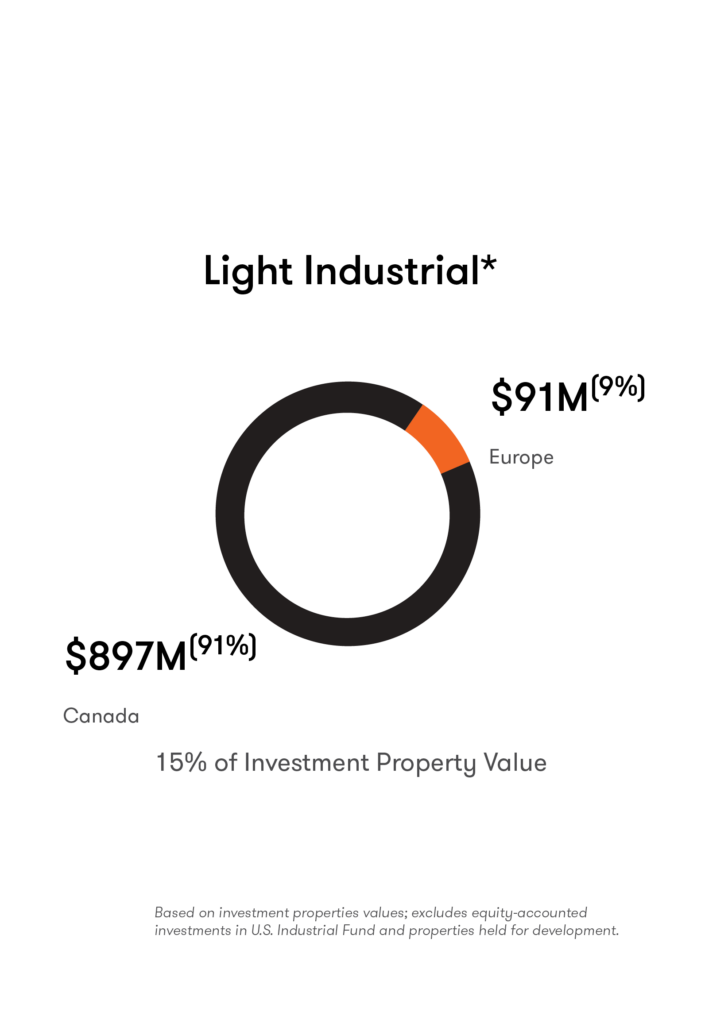

Our assets by building type across our regions, our portfolio consists of distribution, urban logistics and light industrial buildings.

As at June 30, 2024, our investment property value by building type allocated by region is as follows (all dollar amounts in these charts are presented in millions)*

Distribution Buildings

Highly functional big-bay buildings located in close proximity to airports and major transportation corridors, catering to e-commerce and logistics tenants.

Urban Logistics

Small to mid bay properties located close to major population centres and ideally suited to meet last mile distribution needs.

Light Industrial

Mid to large bay assets where tenants have typically invested significant amounts capital and are committed to the space.

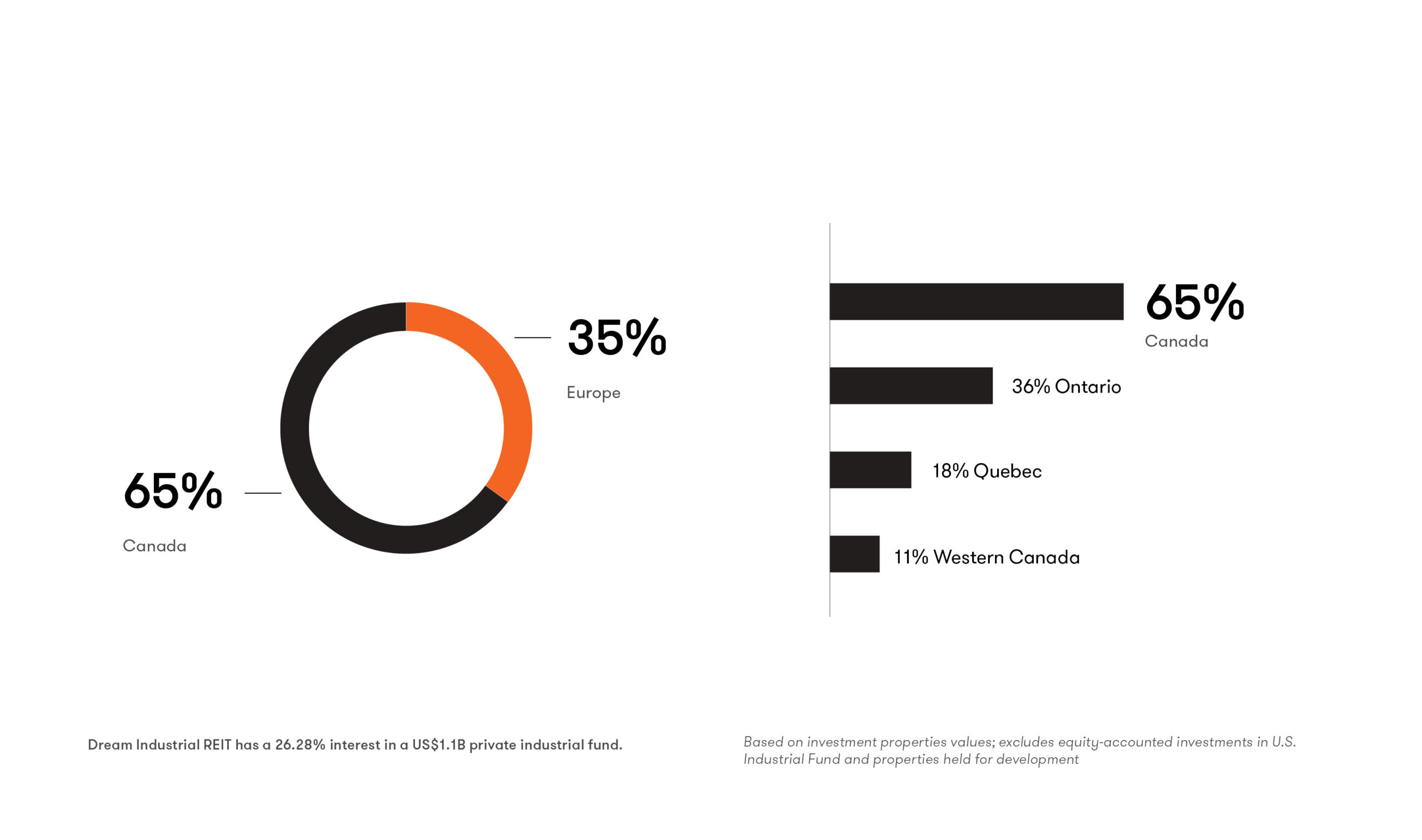

Geographically Diverse Portfolio $7.0B Total Investment Properties Value

Canada$4.6B 65% of investment properties value

Exceptionally well-located urban portfolio located mostly in the Greater Toronto Area, Greater Montreal Area, and Calgary

Europe $2.4B 35% of investment properties value

Urban portfolio located close to dense population centres, primarily in the Randstad region within the Netherlands, Germany, and France.

U.S.26% interest in a US$1.1B private industrial fund

In the U.S., our strategy is to continue pursuing long-term growth alongside strong institutional partners through our retained ~26% interest in the U.S. Fund. A subsidiary of the Trust will provide property management, construction management and leasing services to the Fund at market rates. This is expected to provide a growing income stream to the Trust as the U.S. Fund scales in attractive U.S. industrial markets. This transaction allows the Trust to continue to grow in attractive U.S. industrial markets, improving overall portfolio quality and diversification, while maintaining an enhanced geographic mix.

Focused portfolio strategy

In Canada, our strategy is to acquire mid-to-large-bay properties primarily in the Greater Toronto Area and the Greater Montréal Area where we expect to benefit from increased user demand relative to supply of quality industrial product, and where in-place rental rates are generally below market rental rates and the outlook for rental rate growth is robust. The Trust is also targeting to increase scale in our existing sub-markets and add to our large urban logistics clusters.

In Europe, our goal is to acquire mid-to-large-bay properties in major Western European markets. Across these markets, there is growing demand for urban logistics space, increased user demand relative to supply of quality industrial product, attractive going-in capitalization rates and upside potential from growth in market rents.

In the U.S., our strategy is to continue pursuing long-term growth alongside strong institutional partners through our retained 26% interest in the U.S. Fund. A subsidiary of the Trust will provide property management, construction management and leasing services to the Fund at market rates. This is expected to provide a growing income stream to the Trust as the U.S. Fund scales in attractive U.S. industrial markets. This transaction allows the Trust to continue to grow in attractive U.S. industrial markets, improving overall portfolio quality and diversification, while maintaining an enhanced geographic mix.

Learn more about Dream Industrial

Click HereTeam

Management Team

Our team is made up of the industry’s smartest, most dedicated, knowledgeable and experienced real estate investment, portfolio management and financial professionals that have a proven track record of creating value.

Governance

Dream Industrial REIT is committed to sound and effective corporate governance. Our goal is to not only meet the requirements established by securities laws and regulators but also to uphold the spirit of “good corporate governance” and we always strive to communicate in an open, honest and transparent manner.

Board of Trustees

Committees

Dream Industrial REIT’s Committees assist in the effective functioning of the Board and help ensure that the views of Independent Trustees* are effectively represented.

Independent Trustee

A Trustee that is independent within the meaning of NI 58–101. An Independent Trustee is one who is not an employee or executive officer of Dream Industrial REIT and who is free from any direct or indirect relationship which could, in the view of the Board, be reasonably expected to interfere with independent judgment.

Audit Committee

Governance, Compensation and Environmental Committee

Charters, Policies and Declaration of Trust

Dream Industrial REIT is committed to sound and effective corporate governance. Our goal is to not only meet the requirements established by securities laws and regulators but to also uphold the spirit of ‘good corporate governance.’

News

- Events

- Press Releases